Over the course of 2023, the South African Reserve Bank (Sarb) raised the overnight repo rate from 7.00% to a 14-year high of 8.25%. In the first Monetary Policy Committee (MPC) meeting of 2024, Lesetja Kganyago, governor of the SARB, largely echoed his prevailing sentiments regarding the serious upside risks to inflation, with the committee unanimously voting to keep the repo rate unchanged.

The inflationary risk factors informing the MPC’s outlook are certainly manifold but appear more muted than those that have weighed on the local and global economy over the last two years.

While it is sensible to expect a rate-cutting cycle to begin soon, it might be a short and shallow one given strong

offshore labour markets and US consumer demand, as well as structural constraints within the SA economy that drive up the level of prices.

What keeps Lesetja Kganyago up at night?

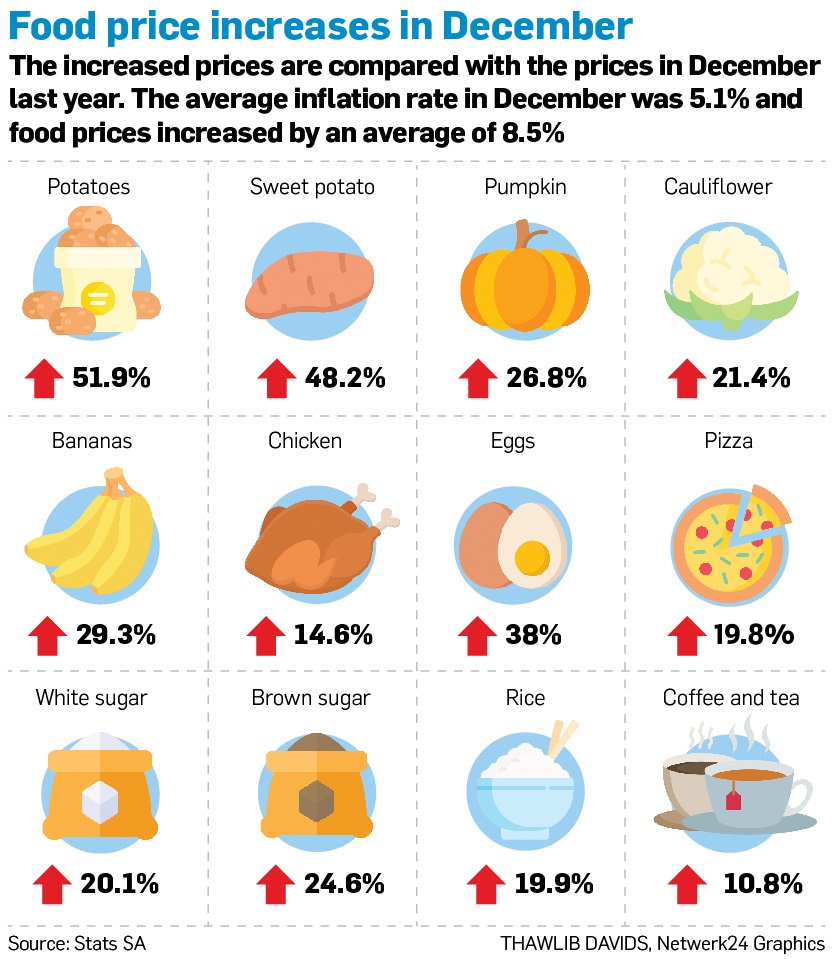

Chief among Kganyago’s concerns are high and unpredictable local food prices, such as those seen in the egg market following the Avian bird flu outbreak and slow progress in local hen vaccinations.

Not only have we have rolled off a large base in prices, but SA has also walked away from the much predicted El Nino weather cycle thus far unscathed and with high yellow maize crop yields.

READ: Consumers under siege as food inflation remains high

Kganyago also remains concerned regarding the inflationary read-through from load shedding and the logistical constraints at SA ports and along Transnet’s rail network.

While these constraints have the capacity to continue to raise the local cost of production, the caveat is that the damage should be more muted than that caused during the peak Stage 6 load shedding of 2023.

When looking at offshore inflationary trends, Kganyago’s apprehensions in large part relate to the strong US labour market and high wage growth, which could ignite second-round inflation effects via robust consumer demand for services and goods.

READ: No reprieve for consumers, as interest rates are expected to remain unchanged for now

The only issue with the US labour market is that there is no issue with it – unemployment remains at around its lowest level in decades.

That said, a third of all global container shipping passes through the Suez Canal and the rerouting of trade via the tip of Africa certainly jeopardises the "just in time" delivery model.

This could represent a transitory upside risk to the inflation forecast if supply of finished goods dwindles or becomes more costly. Large US vehicle manufacturers have already announced they are going to idle capacity during February because of these delays, with some resorting to far more expensive air freighting.

The outsized burden carried by the SARB

Several Sarb members have communicated that high SA interest rates have not been their ideal outcome but have been necessary because the bank carries an outsized burden when it comes to stabilising South Africa’s macro economy and inflation.

While the Sarb's preference would in fact be for lower interest rates and lower inflation, it has not been able to achieve this while government continues to run an imprudently high debt level, which raises the country risk premium.

READ: Lesetja Kganyago: Three major risks facing SA in 2024

This elevated country risk premium entrenches itself in national borrowing costs as foreign investors demand a higher interest rate to invest in the ever-growing supply of South African government debt and to refinance the debt of ailing state-owned entities like Eskom and Transnet.

This country risk premium also contributes to a weaker rand exchange rate and consequently higher imported price inflation.

The Sarb’s final bugbear is that administered prices, such as those for electricity, water, and rates and taxes, have been allowed to rise at double digits and faster than the country’s targeted price inflation.

Such pricing pressures necessitate that the Sarb keeps rates higher than it would prefer as a necessary evil that serves to lower consumer borrowing appetite and crush household demand. In theory, such action is meant to arrest any second-round price increases from taking hold.

The future for rates

Having said this, the market is pricing for the Sarb to begin cutting interest rates in mid-2024 in line with the it's quarterly projection model. Although this model is merely a policy suggestion, it pencils in a short and shallow cutting cycle with the repo rate dropping from 8.25% to 7.3% by end-2025 – which is still 100 basis points higher than its pre-Covid-19 level.

Given the Sarb’s mandate to maintain price stability in the economy and given Kganyago’s expectations for higher and stickier global inflation, a restrictive rate is seen as far more necessary than in the past.

Only time will tell.

Petousis is a portfolio manager of the Allan Gray Money Market Fund

Publications

Publications

Partners

Partners