Many of the articles in this column focus on helping people get out of debt, but credit is not necessarily a bad thing when used correctly. We are familiar with the concept of “good” or “bad” debt.

Typically, we consider an asset-backed loan, such as a house mortgage or car finance, a better credit than consumption-driven debt – such debt is usually charged to your credit or store cards.

Recently I was asked by a young woman, who had just started her first job, whether she should borrow money to pay the deposit for a rental flat.

READ: Personal Finance | Using luxury items to borrow money, does it make financial sense?

She was about to receive her first salary but needed to pay the month’s rent plus a deposit on her flat. She did not have the funds.

This is an example of where short-term credit can be useful, if managed carefully.

WHAT CAN YOU AFFORD?

In her case, the starting point would be to do a proper budget to ensure she could afford the flat. When you start working and leave home, you may not be used to the true cost of living. You may also be tempted to overcommit to living costs such as rent on a flat.

The next step would be to see what she would afford to repay and the length of the loan.

BORROW ONLY WHAT YOU NEED

When you apply for a loan, the credit provider will most likely encourage you to take the maximum amount you qualify for. This can be tempting but, remember, all that money plus interest and fees must be repaid.

Avoid revolving credit facility loans. These are flexible loans that enable you to draw down funds and then repay the money and withdraw again. These do not have a fixed term, so you can find yourself permanently living on credit and often using the funds for lifestyle reasons.

THE COST OF THE LOAN

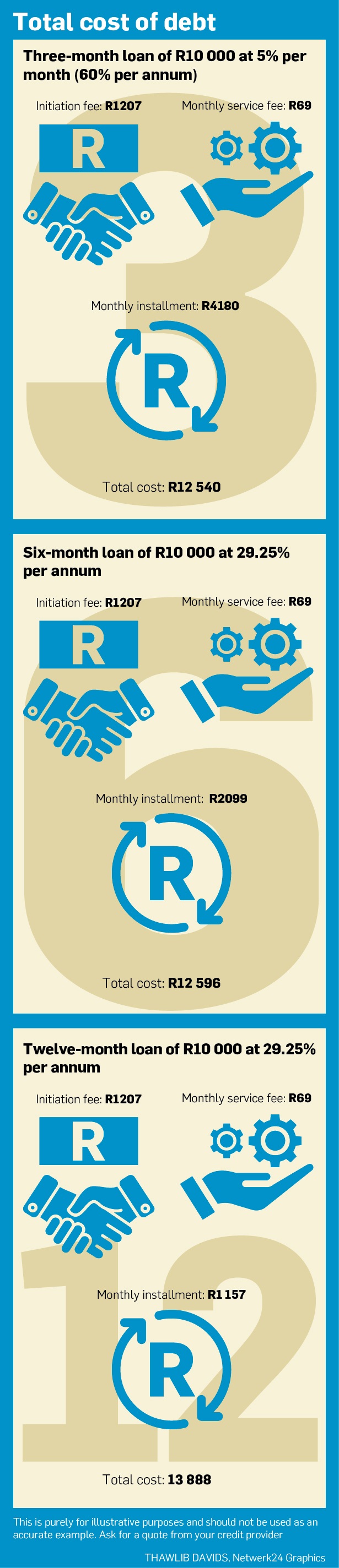

Make sure you understand the total cost of the loan. Apart from interest, you will be charged an initiation fee and monthly service fee.

READ: Personal Finance | Beware of promises: No one can get you out of debt if court order is issued

The initiation fee is added to the loan amount and can have a significant impact on the repayment. The credit provider may also add on other costs, such as insurance.

You have the option to negotiate this and use your existing insurance to cover the debt in case something happens to you.

However, on a personal loan of six months or more, the interest rate is capped at 21% above the repo rate, which is currently 29.25% per annum.

This will have an impact on the cost of your loan, so it is important to find out what interest you will be charged. You can negotiate your interest rate and shop around for the best deal. But always ask for the total cost of the loan so that you can make a proper comparison. You then need to select a repayment period to ensure that you settle the loan in a reasonable time, without putting yourself under too much financial pressure.

In this case, the three-month loan has a similar total cost to the six-month loan. However, the monthly instalment on the six-month loan is more affordable, in which case it could make sense to take the six-month loan.

It is therefore important for you to understand all the cost implications and to ask questions before taking that loan. If you decide to take a loan for a specific need, make sure you pay it off before you take on any other debt.

Do not create a habit of using short-term debt to finance your lifestyle. That is where the debt trap starts.

Publications

Publications

Partners

Partners