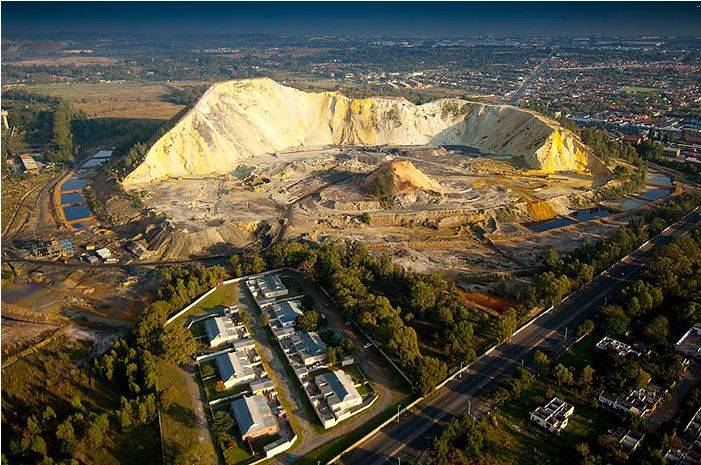

- DRDGold, which produces gold from mine dumps, wants to move into green metals.

- The group's business model speaks to a global trend toward greater concern for environmental and societal impact.

- DRDGold on Wednesday declared a dividend for the 15th consecutive year in a row.

DRDGold is keen to move into other metals in order to align itself with the green metal strategy being implemented by Sibanye-Stillwater, its largest shareholder.

DRDGold, listed on the JSE, produces gold extracted from waste dumps and is 50.1% owned by Sibanye-Stillwater.

Sibanye, a gold, and platinum mining group, is pushing into battery metals, which are increasingly in demand for the transition away from fossil fuels in favour of cleaner alternatives.

Last year the group announced several acquisitions, giving it exposure to metals like nickel and lithium, while a deal to acquire nickel and copper assets has since been cancelled following a pit wall collapse.

At the release of DRDGold’s interim results on Wednesday, CEO Niël Pretorius said the company intends to align itself with Sibanye. "Where Sibanye-Stillwater goes, we want to go and see what opportunities are presented."

He, however, said it is too early to speak of specific projects. "But the conversations that we're having at this stage are good. I think the right people in Sibanye-Stillwater have taken an interest in what we do."

While Sibanye-Stillwater has expressed confidence in uranium as a green metal for its use in nuclear power, Pretorius, however, indicated that uranium production, although not out of the question, was probably a bridge too far for DRDGold at the moment.

"It's not something that we are explicitly targeting. Simply because we do not have resources at this stage," he said. "These are very expensive plants to build, we will probably venture into something a little bit less challenging initially."

In releasing its results on Wednesday, DRDGold declared an interim dividend of 20 cents per share from 40 cents previously, following a drop in earnings for the six months ended in December.

Group revenue decreased by 16% to R2.4 billion mainly due to a 13% decrease in the average rand gold price received as well as a 4% decrease in gold sold.

Operating profit decreased by 42% to R832.0 million from R1.4 billion.

The operating margin of the group was 33.3%, compared to 48.4% in the comparative period.

Headline earnings of R495.9 million were almost half the R949.2 million in the comparative period.

Free cash inflow of R406.9 million for the half-year moved cash and cash equivalents to R2.2 billion and enabled DRD Gold - which has no bank debt - to declare an interim dividend, without inhibiting its capital investment programme.

This marks the 15th consecutive year that the company has paid dividends.

The company noted that the DRDGold business model is in sync with the global thinking on environmental and societal impacts of mining.

While the world is determined to transition toward green energy, it is also determined to oppose mining, Pretorius said. "As a consequence, accessing resources is going to become increasingly hard. And the ones that are probably the most accessible are the ones that are already stockpiled in mine waste dumps across the globe.

"And that's really where our focus point is, and where we want to take this model [to use] greywater and clean energy and produce those metals. So I think we're at the threshold of exciting times, which we do want to pursue parallel with Sibanye-Stillwater."

Publications

Publications

Partners

Partners