Ubank, which has around 4.7 million accounts - mainly among mine workers and their families - has been placed under curatorship.

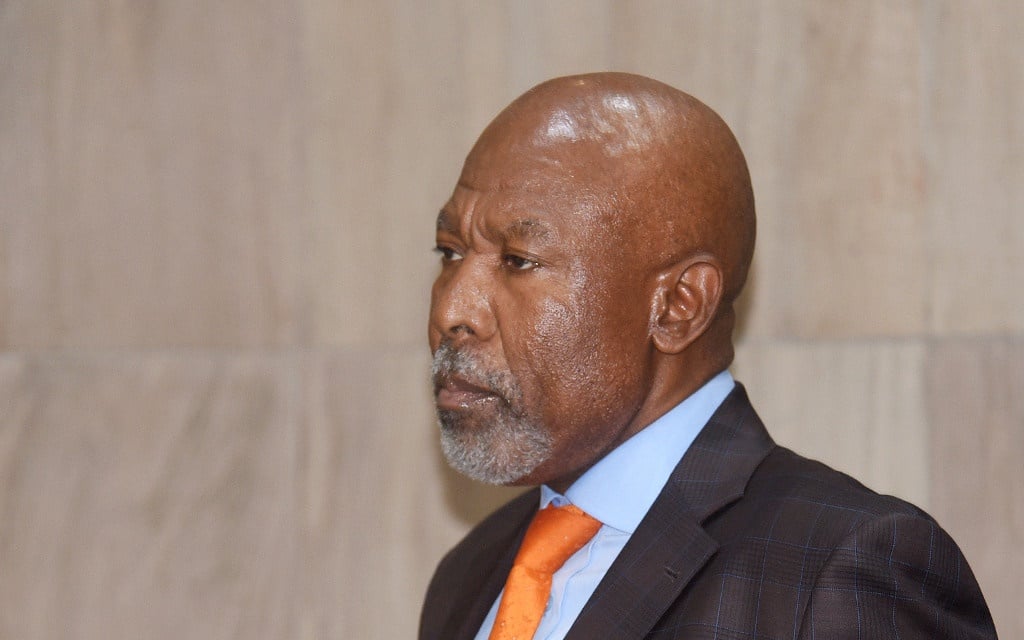

SA Reserve Bank governor Lesetja Kganyago says there are concerns about the bank’s capital adequacy, as well as about its weak corporate governance and lacking corporate internal controls.

KPMG South Africa has been appointed as the curator, with KPMG director Zola Beseti as the representative.

"KPMG South Africa will be responsible for Ubank with immediate effect," Kganyago said.

Ubank remains open for business, remains highly liquid and will continue to grant loans, he stressed.

However, with a balance sheet of more than R5 billion, Ubank only has a capital adequacy rate of 3%, while it should be closer to 20%, Kganyago said. Retail depositors represent 98% of Ubank’s total liabilities.

Ubank – previously known as Teba Bank – was granted a banking licence in 2000, and grew out of Teba Cash Financial Services, which had been providing financial services to mineworkers since 1975.

Ownership in the bank remains in a trust managed by trustees elected by the National Union of Mine Workers (NUM) and the Minerals Council of SA.

The Gupta-linked Oakbay Investments once expressed an interest to buy UBank, but at the time NUM was adamant that the bank wasn’t for sale.

Now, Kganyago says the Prudential Authority is aware of interested parties that have been discussing investing in Ubank. These investments, if concluded, will resolve the issues at Ubank. The curator will take this process forward.

Two years ago, MTN launched a mobile money service with UBank, MoMo.

The NUM said it was "highly shocked and surprised" by the announcement.

"This happened despite the Ubank’s board commitment [on Sunday] night that it will raise the required R800 million to save the bank from being placed under curatorship," the union said in a statement.

"The Ubank board managed to raise the required money and the NUM is shocked by this latest development."

Publications

Publications

Partners

Partners