- An example in a Treasury document has caused concern about the tax treatment of the so-called "savings pot".

- Treasury addressed these concerns, confirming that not accessing your savings before retirement will have big tax benefits.

- The new two-pot system is supposed to take effect in March.

- For more financial news, go to the News24 Business front page.

Amid some confusion about how two-pot pension payouts will be taxed, Treasury provided clarity on Wednesday.

The new two-pot system means South Africans will be able to cash out one-third of their future retirement savings throughout their career, while two-thirds will only become accessible on retirement. The one-third component is called the "savings pot", while the other two-thirds is the "retirement pot".

When the new proposed legislation was made public earlier this month, there was some concern as an example in the explanatory memorandum was inconsistent with the wording included in the draft bill, making it appear as if all the money in the one-third savings pot would be taxed as normal income on retirement.

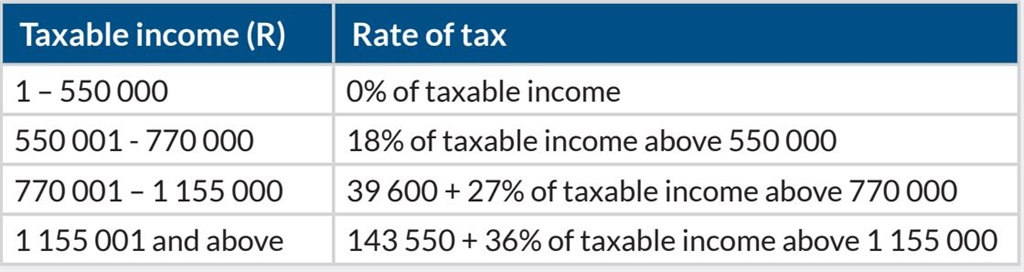

Currently, the first R550 000 of all lump-sum payouts on retirement is tax free, and the balance of the lump sum is taxed at lower tax rates as set out in the table below:

'Good news' on tax incentives

On Wednesday, Treasury confirmed that withdrawals from the savings pot upon retirement will also still be subject to lump sum rates – and won't be taxed at the much higher normal income rates that will apply to early withdrawals.

"This is good news as it confirms that the status quo with regards to tax incentives supporting preservation of the full retirement pot (retirement component and savings component) remains in place after implementation of the two-pot system," says Pieter Koekemoer, head of personal investments at Coronation Fund Managers.

"These tax incentives are meaningful."

If you withdraw money from the savings pot before you retire, it will be taxed at marginal rates (between 18% and 45%), while waiting to take the lump sum at retirement will be taxed according to the retirement lump sum table (from 0% to around 35%) – with the first R550 000 tax free.

So, for example if you earn around R673 000 a year, and you withdraw money early from the savings pot - 39% of that amount will go to SARS.

But if you wait until retirement before taking a lump sum - on an amount of R2 million, you will pay an effective tax rate of only 22.4% - regardless of any other taxable income earned in the same year.

"One of the points that often gets lost in the discussions around the two-pot system is that its purpose is to balance the need to achieve better preservation of retirement pots so that more adequate retirement incomes can be provided and the need to provide some early access to retirement assets in the case of hardship," says Koekemoer, adding:

The savings in your retirement pot that are not paid out as a lump sum on retirement, will be received as a monthly annuity and taxed as individual income.

The new two-pot retirement system is supposed to take effect in March 2024. The system is meant to deter South Africans from cashing out their retirement savings when they resign, and to prevent workers from resigning to access their retirement funds.

Members of retirement and provident funds, as well as retirement annuities, will be able to withdraw a once-off R25 000 or 10% (whichever is less) from their existing savings from March next year.

Old Mutual expects more than one million members in its retirement funds to apply for the payout.

Publications

Publications

Partners

Partners