- Mysterious buyers are allegedly lining up to save the "hopelessly insolvent" Habib Overseas Bank.

- Habib is the bank the Gupta family once tried and failed to acquire and has recently been implicated in corruption and money laundering.

- The South African Reserve Bank wants to press ahead with liquidating the bank, which it says requires "at a minimum" R364 million to keep going.

- For more financial news, go to the News24 Business front page.

Mysterious anonymous investors from Limpopo, Saudi Arabia and Dubai, as well as one of Botswana's richest politicians, are allegedly all separately poised to spend hundreds of millions of rands to save and take control of the controversial Habib Overseas Bank.

Habib is the same bank the Gupta family, through proxies, sought to take control of in 2016 when the family was losing access to all the major local financial institutions.

It has also been the subject of an amaBhungane exposé revealing large-scale money laundering.

These new alleged bids are being endorsed by a group of account holders claiming to represent almost a quarter of the deposits left in the crippled bank. In the process, they have temporarily blocked the South African Reserve Bank's (SARB) attempt to liquidate Habib and potentially hunt down misappropriated monies.

The diverse collection of interested parties includes Satar Dada, a Botswanan magnate and parliamentarian who serves as the ruling Botswana Democratic Party's treasurer.

Also in the running is Durban businessman Barlow Gonaseelan Govender, who claims to have the informal support of the Public Investment Corporation. The state-owned asset manager ignored a request for confirmation.

The key figure in the profusion of (potential) bids is Yunus Paruk, a former director and shareholder at Al Baraka Bank in South Africa.

In court papers, the depositor group claims that Paruk became a go-between for the various interested parties.

One of them is allegedly an anonymous suitor from Dubai represented by "deal maker" Anwar Khan, who runs a "boutique advisory firm" called Adsum Capital Management in the United Arab Emirates.

Khan, incidentally, used to work for the Pakistani Habib Bank Limited, which is not affiliated to Habib in South Africa but was founded by members of the same extended family, which also has separate banking interests in the UK.

Paruk was also the point of contact for the Botswanan Dada. According to the court papers, the two are partners in a property business.

A "prominent business family from Limpopo" is also interested, with an unnamed US investor in tow.

And there is also allegedly a "Saudi Arabia-based consortium" interested in buying Habib.

The depositors have approached the court to force the provisional liquidator of Habib, Zeenath Kajee, to disclose detailed financial information so that all these potential buyers can conduct due diligence exercises before making actual offers.

This case is running in parallel to the group's opposition to the Prudential Authority's attempt to liquidate Habib. The PA is the division of SARB which regulates banks.

This new slate of potential buyers is not the first. The owners of Habib had in fact already entered into a sales agreement in November last year with a company called Shop2Shop, which seems to have fallen by the wayside.

While depositors understandably want to recover their money, the profusion of mostly anonymous 'white knights' raises some red flags:

- First, Habib is in bad shape, requires immense amounts of money to resuscitate, and appears unsustainable – making it unclear why anyone would buy it other than to acquire a banking license;

- Second, the fact that Habib's banking license has been abused in the past to facilitate money laundering; and

- Third, the blanket anonymity surrounding most of the alleged suitors.

Financial black hole

Habib was placed under curatorship in March this year and the Prudential Authority subsequently applied to court to liquidate it after the curator concluded that the bank is "hopelessly insolvent" and would require "at a minimum" R364 million just to meet regulatory requirements, much less actually operate.

And to operate, much more money would be needed to effectively overhaul the whole bank, which runs on inadequate systems and has an "unsustainable" business model, claims the central bank.

Furthermore, that is before Habib tries to overcome its descent into infamy due to its association with money laundering.

Meanwhile, the Prudential Authority claims that even if there were a serious buyer, the due diligence and transfer process would take months and lead to the worsening of the bank's finances, with no guarantee it would not be liquidated anyway.

Before the extent of its financial woes was fully known, the initial reasons the bank was shut down prominently included "compliance, governance and operational failures".

In its liquidation application, the SARB revealed that it had imposed "a limitation of its exchange control license" in 2021, seemingly in response to the bank's role in illegally expatriating funds.

This led to a precipitous drop in Habib's income that coincided with the general economic downturn brought about by Covid-19.

These factors seemingly precipitated a snowballing withdrawal of deposits.

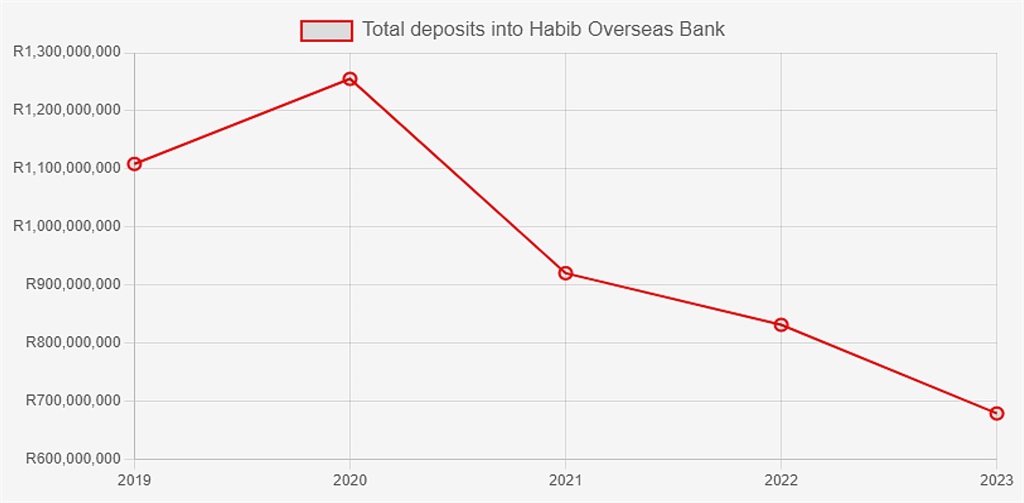

According to SARB, data deposits at Habib plummeted by almost 30% in the immediate aftermath of losing its full forex abilities. This trend continued up to the beginning of the curatorship, by which time the depositor base had halved from its 2018 high point of R1.3 billion.

A hopeless case

Habib's financial declarations to the SARB, while already dismal, do not even square with what the curators found.

According to official filings, Habib was insolvent to the tune of R64 million. This is really closer to R114 million, according to the curators, who have applied their own analysis of how sound the loan book is.

On top of that, a bank is supposed to have minimum capital of R250 million. Added together, this comes to the minimum R364 million Habib needs if it wants to even exist as a bank legally.

Three of Habib's non-executive directors resigned together on 24 February, about a month before the bank was first put under curatorship. This was one day after the SARB wrote to Habib after the bank breached the minimum requirement for capital adequacy.

One of these directors was John Henry Burke, a former director of the JSE who came on board last year on the invitation of Habib's CEO Henk Engelbrecht. Another was Douglas Lorimer, formally of Absa, and another was Deborah Mutemwa-Tumbo – a lawyer and colleague of Lorimer.

All three told us that they resigned when the shareholders of Habib, being the Habib family, allegedly reneged on a promise to keep providing capital to keep the bank afloat.

But it is worse than that.

The curators' report attached to the SARB liquidation application paints a grim picture of a crumbling institution with barely functioning computer systems, patchy records, and essentially no proper upper management.

Customers were not properly vetted and documents were not verified, while there are indications of corruption by at least 29 employees.

The scale of financial crime at Habib is potentially an order of magnitude larger than what occurred at the infamous VBS Mutual Bank, the only other bank failure in recent South African memory.

The SARB has suggested that it intends to pursue malfeasance by individuals at the bank and needs a rapid liquidation so that "necessary proceedings can be pursued to hold those accountable for [Habib's] demise".

"The longer it takes for the appointment of a liquidator and for steps to be taken, the more unlikely the recovery of monies and other assets from potential recipients will be."

Which underscores the strangeness of the arrival of as many as five, mostly anonymous, prospective 'saviours'.

It remains to be seen whether any of these suitors actually raise their heads above the parapets and whether Habib will be put out of its misery or miraculously revived.

*This story has been corrected to reflect that Yunus Paruk is a former director and shareholder at Al Baraka Bank, and not the marketing manager.

Publications

Publications

Partners

Partners