- Zambia, Ghana, Ethiopia and Chad need urgent debt relief.

- The G20's debt restructuring for African countries is moving at a slow pace.

- African states should also be wary of 'vulture funds', which exercise loan shark-like tendencies.

African countries should move away from primarily agriculture-based economies to light industries (less capital-intensive industrial subsectors such as food processing, textiles, consumer goods, vehicles and machinery) if they are to manage to service their debts, a conference has heard.

They should also stay away from corporate loan sharks as their debt spirals out of control, mainly because of the slow pace at which a G20 framework to restructure debt is being implemented.

African countries gathered for a conference on debt and development last week to compare their different fiscal positions and find common solutions.

Some have it worse than others, but few African countries have it good. So far, Zambia, Ethiopia, Chad and, most recently, Ghana have applied for relief from international creditors.

Kenya is likely to follow, after the strain on its external debt increased in 2022 as a result of the US tightening its monetary policy as well as Russia's invasion of Ukraine.

African Forum and Network on Debt and Development executive director Jason Braganza told News24: "The situation is being made worse by the slow progress in renegotiating with creditors and by the advice given to governments by their development partners about continuous borrowing."

Most African countries owe money to the Paris Club – a group of officials from major creditor countries, including the UK, the US, Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany and Switzerland.

They also owe China, the biggest bilateral lender, over R1.3 trillion as of 2020.

Chinese private lenders are owed some R162 billion, according to the Oxford University politics blog.

Braganza said:

"In the second crisis, it's the credit landscape: You see many African governments relying on borrowing from capital markets. We are taking up more commercial and private debt, both of which have very short turnaround periods but a long window on return on investment."

This makes renegotiating and restructuring very complicated.

READ | Creecy: Climate finance shouldn't worsen Africa's debt burden

Country credit ratings by organisations such as S&P Global, Fitch, and Moody's make African countries secretive about their debts.

"They [ratings] act as a disincentive for countries to be open and transparent about how bad their debt situation is turning out to be at the domestic level," Braganza added.

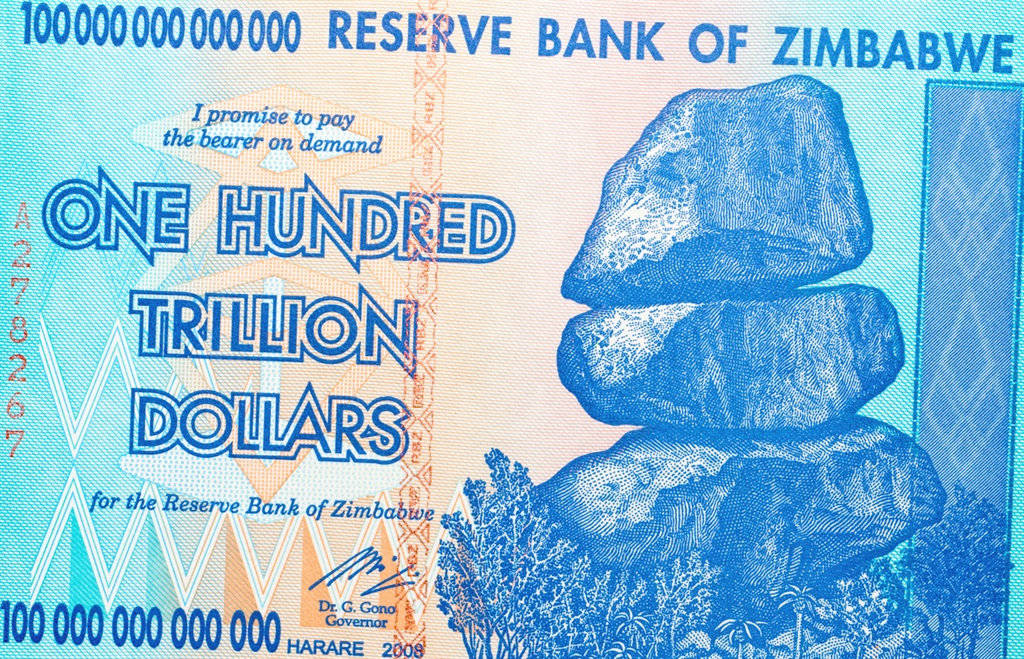

This can be made worse by "vulture funds", which, according to the African Development Bank, purchase distressed debt on the secondary market (where it trades significantly below its face value) and then seek to recover the full amount, often through litigation.

Fixing debt requires less growing and more making

Braganza said there was a need for a shift in the mindset of African leaders and industrialists towards "moving from a primarily agrarian economy, which is what we have, to light manufacturing and industrialisation, then up the value chain in those sectors. That is what leads to revenue remobilisation increasing..."

Staying clear of vulture funds is imperative, Ohiocheoya Omiunu, a reader in international economic law at the University of Kent Law School in the UK, told News24.

Just ask Peru and Argentina.

"These funds will hold out and won't join the restructuring process because they bring their parallel actions through the courts," said Omiunu.

The News24 Africa Desk is supported by the Hanns Seidel Foundation. The stories produced through the Africa Desk and the opinions and statements that may be contained herein do not reflect those of the Hanns Seidel Foundation.

Publications

Publications

Partners

Partners