This article forms part of the archives of Business Insider South Africa, which was published as a partnership between News24 and Insider Inc between 2018 and 2023.

- SA shares have performed poorly - and investors need to make sure their every rand is working hard.

- Fees and tax are two important areas of "leakage" that need to be plugged, says a wealth advisor.

It has been a very tough time for anyone invested in South African shares. The JSE’s index of all shares has lost 7% so far this year, and the market is back where it was at the start of 2017. Taking inflation into account, your retirement fund or unit trust probably have taken a big hit.

So how should this impact the way you grow your money?

There are three important things you need to take into account, certified financial planner Craig Gradidge wrote in a recent Fin24 column. Gradidge is director of the wealth manager Gradidge-Mahura Investments, which was recently rated South Africa’s top wealth manager, according to a survey conducted by research firm Intellidex.

The first two principles are well-worn investment adages: be patient and diversify. You have to invest in a range of different assets (like shares, property, cash), different places (in South Africa and beyond) and different products (like unit trusts, tax-free investments and retirement annuities). And then you have to take a long-term view: chopping and changing your investment will hurt performance.

The third principle is often overlooked: managing leakage.

Gradidge details two ways investors are wasting money unnecessarily.

The first is fees.

If your unit trust charges massive fees, obviously that will eat into your investments in bear markets. Much has been made about how cheap index funds are compared to traditional unit trusts. (You pay more for the latter because fund managers charge fees for picking shares; an index fund simply tracks an index of shares.)

However, Gradidge has a warning.

“Investors should be cautious not to get sucked into the aggressive ‘cheaper is always better’ messaging, because it is certainly not.”

The graph below shows the performance of index-tracking balanced funds. Included in the graph is the Allan Gray Balanced fund, which is significantly more expensive than all of the index balanced funds. (The performances below are net of fund fees.)

“The relatively expensive fund has outperformed all the cheap funds... confirming the point that fees alone are not the only consideration. There is also a significant dispersion in returns between the various index tracking balanced funds themselves.”

Best performer over the period, Prescient Balanced, outperformed the worst performer, 10x High Equity, by 7.1% over the period. That is more than a 2% per annum difference in return, and there’s less than a 0.50% per year difference in fees, Gradidge remarks.

“A well-balanced portfolio at a relatively cheap price will serve investors well over time. Interesting to note that all the index balanced funds outperformed the balanced fund sector average (SA-Multi Asset-High Equity) over this period affirming the point that fee management in a low return environment is important.”

Tax is the other area of leakage.

When share prices are going down in flames, the typical response from investors is to run for the safety of money market and savings accounts.

“While these are great at protecting capital in the short term, their returns are highly inefficient from a tax perspective.”

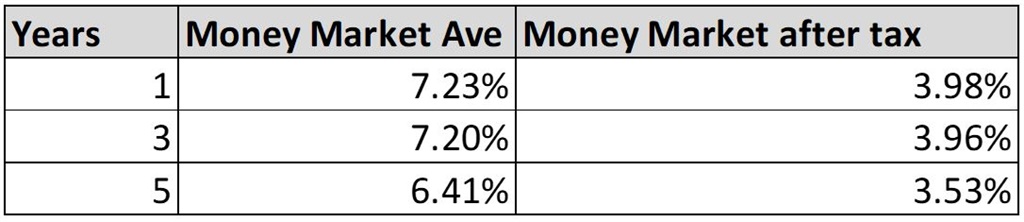

The table below shows the net of tax return for an investor who pays income tax at the highest marginal rate of 45%.

Receive a single WhatsApp every morning with all our latest news: click here.

Also from Business Insider South Africa:

- Vodacom’s data prices fell 16.4% in six months – and the customers are streaming in

- These are SA's top YouTube channels, including kids shows and a Brakpan man with pet tigers

- These are the 16 liquor brands rich Africans like best – including a R1,649 Japanese whiskey

- This is the ‘fainting’ dance craze taking SA by storm – and no, Limpopo is not lining up extra ambulances

- SA has 'the most representative flag' in Africa – here's why

- This is officially what the new Macbooks and iPads will cost in SA

- Watch: 10 of world's most interesting cultural rituals - including jumping over babies and a Japanese penis festival

Publications

Publications

Partners

Partners